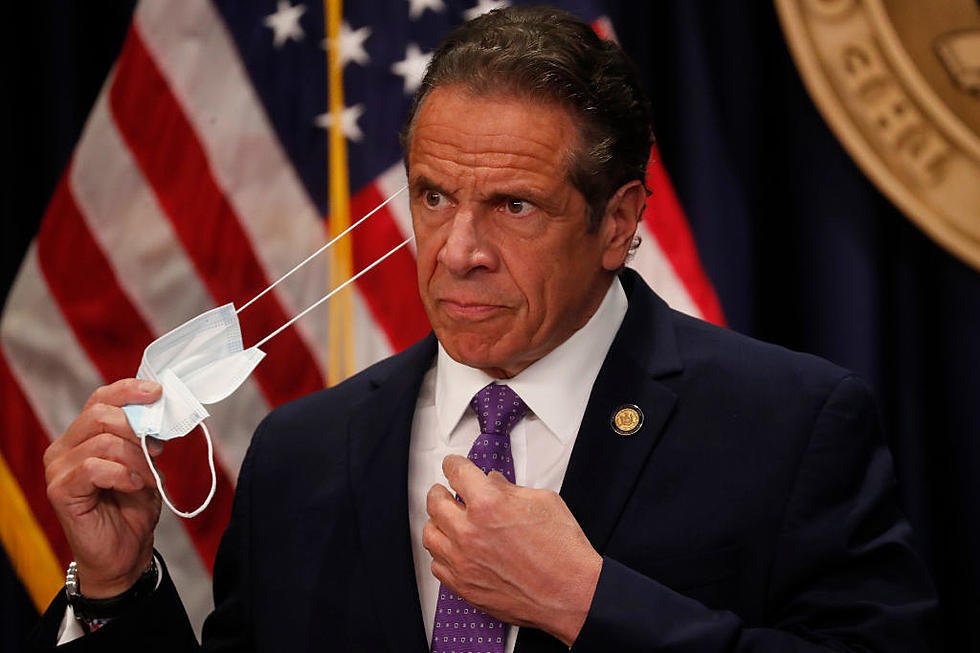

Governor Cuomo Changing State Tax System

Governor Cuomo plans to revamp the state tax system by creating more income brackets. The new brackets would better spread the burden between the state’s poorest and richest residents. The governor said right now a person who earns $20,000 and another who earns $20 million pays the same permanent income tax rate of 6.85 percent.

Cuomo released a statement yesterday explaining his plan a little bit further. He stated, "It's just not fair," that these individuals would pay the same marginal tax rate. Cuomo also noted that 28 states as well as the federal government have wider ranges that help distribute the tax burden more fairly. So why ................................................................................................ shouldn't New York have a similar system.

Permanent tax rates in New York range from 4 percent at the low end to 6.85 percent at the high and are separated into five brackets. The top level is at $40,000 for joint filers. If changes are made, the most immediate change would effect those who earn more than $200,000 and $500,000 and the temporary surcharges that expire at the end of the month.

Supposedly, Cuomo is also pushing for a true millionaires' tax that would apply to anyone making more than $1 million a year or close to that amount. He has also proposed a tax cut for middle-class families. Cuomo defines middle-class families as earning less than $300,000 annually.

Lawmakers will be traveling to the Capitol to discuss the tax revision plan. A vote could handed down as well. Assembly Democrats are expected to meet at 3pm today while Senate Republicans will be hosting a conference at noon tomorrow.

More From 107.7 WGNA